Social media’s original purpose was for friends and family to stay connected with one another. Since its birth, it has evolved into more than just a way of communicating. It’s an effective medium to get in front of your customers. Often, banks, wealth management firms, and insurance companies skip out on this marketing opportunity because of the fear of breaking regulations with compliance. Do not fear compliance. With your own policy and social media strategy, you’ll soon be adding another powerful marketing asset, connecting with new potential customers, and having more people walk through you door.

Is it actually worth the risk?

Yes. The average person maintains more than 5 social media platforms. Millennials specifically use it when they wake up, multiple times throughout the day, during their downtime, and right up to the moment they fall asleep. If they’re using it, you need to use it, too. This group is quickly gaining purchasing power. Get in front of them before they make the final decision on opening a checking/saving account or gaining financial advice from one of your competitors. Yahoo! states, “50% of shoppers have made a purchase based on a recommendation through a social media network.” Your presence on social is critical to staying relevant in today’s digital world.

How to Start

Many banks and firms have had many mergers and acquisitions. So, there may be social media accounts associated with previous company names that lead to your current website, address, or phone number. Gain access, merge your pages, or delete old accounts that have nothing to do with your current brand. Not only do you need to think about the business’ accounts, but some employees may be marketing themselves through social media. If you do not have someone monitoring, you have no insight into what your employees are saying (social’s not just about your customers).

Once you have the appropriate channels, you’ll need to decide what you’re goal is for them. Obviously, gaining more customers for your business is one of them. But, this may not be the true purpose of your pages. Goals may include to quantify content to a dollar amount, to educate your followers, to recruit, or to provide faster customer service. Defining this will help you get started on the type of content you will be providing and give you a clear vision of where you are heading.

Posting Without Fear of Compliance

The FINRA, the SEC, FFIEC, and the FDA will need to know about your social media channels and you know they will be auditing your content. Creating a standard strategy for you and your employees to abide by will help you to avoid violating any regulatory guidelines while maintaining full control on all content disseminated online. Setting these standards on what you expect to see will leave anyone with admin access in a comfortable position for posting onto social media. Avoid the madness, completely, and never have an issue with compliance.

Get to Know Your Customers

Monitor the conversations that are happening about your brand. The first place people go to complain, to brag, and to share their opinions is a social media account. You’re leaving your reputation in the hands of others without any say. Be a part of the conversation. If a negative comment occurs, be the first to respond. Having a social voice will not only help your credibility; you’ll soon truly get to know your customers. What are their interests, hobbies, locations, and languages? What do they like or not like about you? Where did they come from or go after interacting with your brand? Answering these questions will eventually help you in all areas of marketing for your company. If you want customers to invest their time and resources into you, you need to invest in them.

Working With a Social Media Marketer

We’ll do what we need to in order for you to have peace of mind about your new venture. We’ll help you educate your employees – what they’ll need to look out for, how to build those relationships, themselves, on their own channels, and the appropriate language and wording. We’ll thoroughly explain the strategy to leave no one questioning any part of it. We’ll help you gain access to all of your previous channels and secure each page. Our social media management tools have built-in compliance features that will help us all avoid disasters. Most importantly, we will create a crisis management procedure if a problem were to occur. The combination of a social media marketing team and a compliance officer will allow your content to be accurate and entertaining for your followers. (Yes, entertaining. Your boring content won’t get you anywhere. We’ll give you a personality compared to your standard legal jargon.)

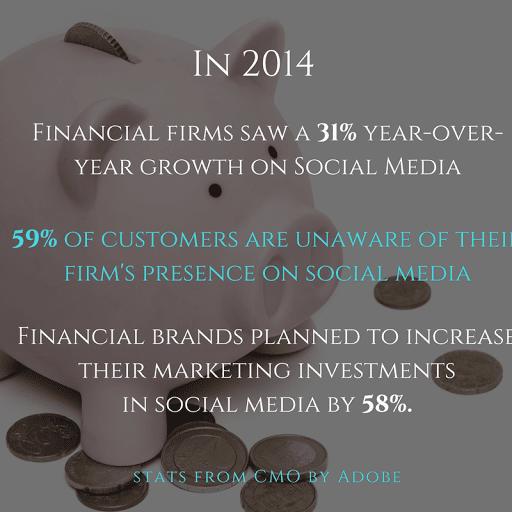

Example of Financial Companies Utilizing Social Right

We understand the uncertainty you may feel about utilizing social media marketing. There’s the pressure of legal limitations and costly violations if an error occurs; but, you must soon realize the pressure is even greater to be active on social media. You’ll soon be a forgotten face in a crowd of your competitors without it.